Now that we are nearly one week into level 2 and many of us have returned to office and getting back to some form of normality, it’s time to ensure that employees are paid correctly for time worked and also that we are taking the new minimum wage into account.

The Wage Subsidy

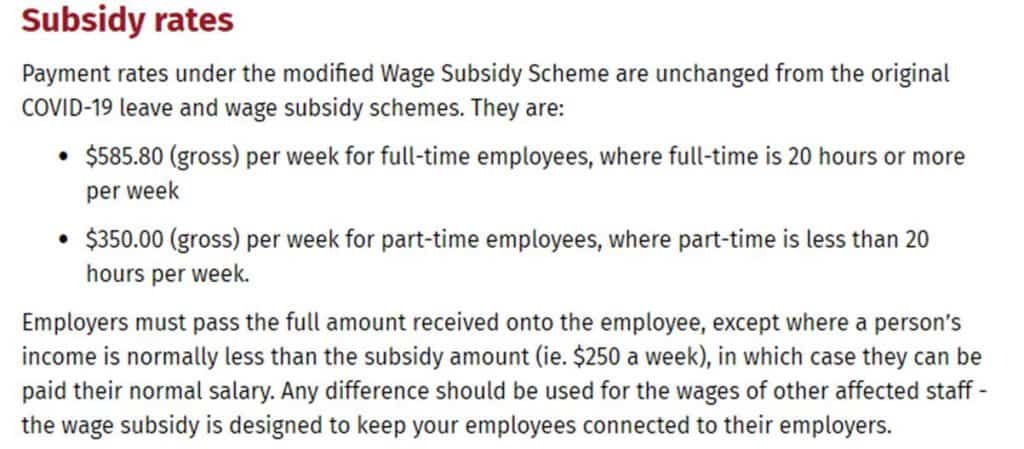

Those who have applied for and received the wage subsidy, may have paid employees in full, 80% or some other agreed amount, with the minimum being at least passing on the wage subsidy, while employees were unable to work.

It is important that there is a good record of the handling of the wage subsidy via your payroll and accounting systems as this may be subject to audit in the near future. You must be able to show that you have passed on at least the wage subsidy amount to employees.

Agreements

However, employers should still apply the rules and conditions under employment law and employment agreements with their employees when they are able to return to work and start working. The Wage Subsidy is there to support paying employees, but they should be paid for their time worked based on their current employment agreements.

If temporary agreements were put in place during the COVID lockdown periods, these should be reviewed or removed as applicable and an agreement reached as to how employees will be paid when they return to work. Employees must agree to the new terms, if these are different to their pre-COVID agreements.

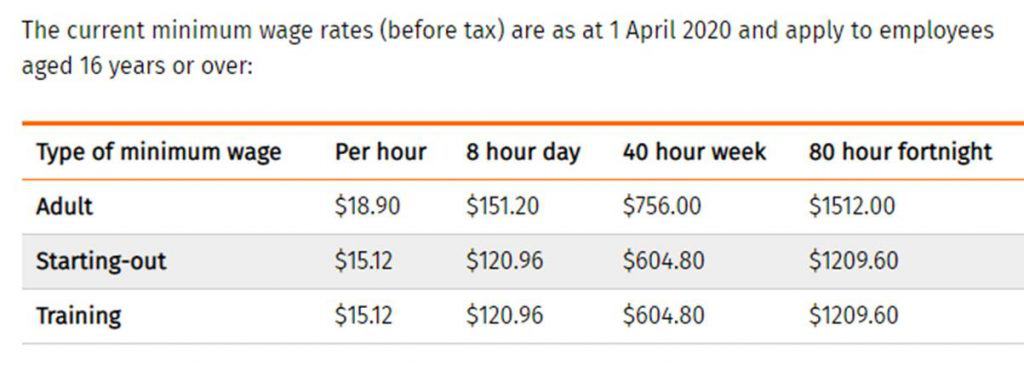

Minimum Wage

It is also important to remember that the adult minimum wage rate has changed to $18.9 on 1 April 2020, which is during the lockdown period. Some companies may need to update the new rate or settings in their HRIS or payroll systems. More on the impact of COVID-19 on the minimum wage here

Company and employee tax

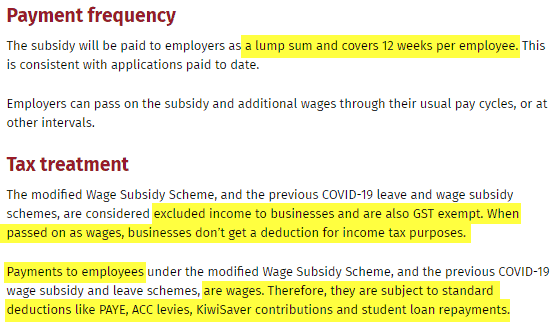

Employers should also pay attention to their own and their employees’ tax obligations. In summary, the wage subsidy when paid to the employer is not seen as revenue and hence not subject to Tax of GST. However, when paying the employee it is seen as salaries and wages and subject to PAYE, ACC and other relevant deductions as well as leave accruals/accumulators.

We are here to help

Integrity1 is an executive/corporate payroll consultancy, employing Payroll, HR and HRIS professionals with many years’ experience in corporate and technical roles. We are here to work together with you and support your business and payroll team.

- Integrity1 can help you identify and configure any needs to make changes to your payroll system in response to changes in working conditions such as new leave types, rate changes, wage subsidies, minimum wage, absences and more

- We can assist you with a post-lockdown risk and disaster recovery review and plan a roadmap with you

- Our team can help you implement any changes in configuration or change in system which you may decide are required to mitigate future risk

- We are able to offer all our current services remotely or online, including consulting, training, audits, remediation and implementation assistance